Paid Sick Leave & Minimum Wage Update

Navigate the New Paid Sick Leave & Minimum Wage Rules

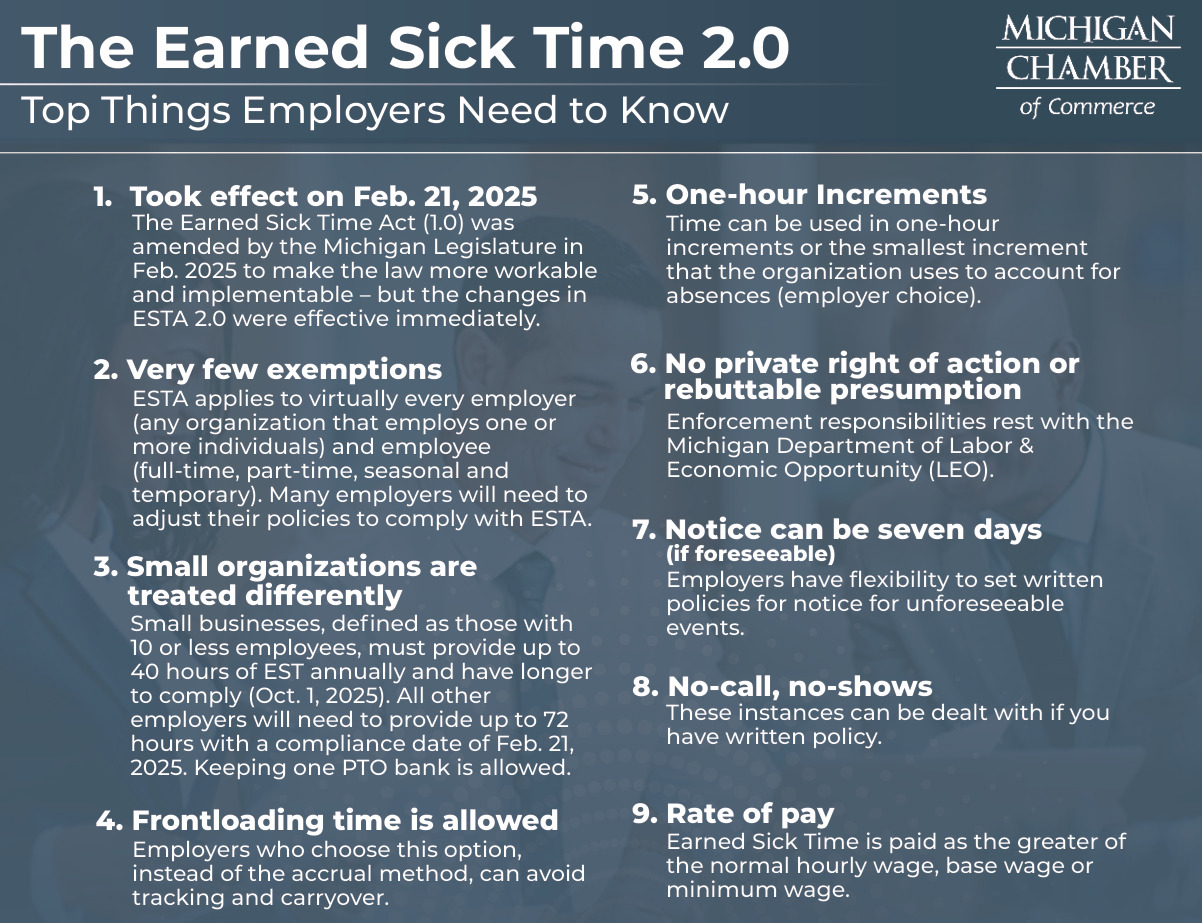

The Michigan Supreme Court issued a major ruling impacting businesses of nearly every size and new paid leave and minimum wage requirements.

This page is dedicated to supporting employers in navigating the changes to paid sick leave and minimum wage laws set to take effect on February 21, 2025. Here, you'll find valuable resources as well as to explore these tools and information to stay informed and prepared for compliance.

New Labor Law Compliance: Resources & Next Steps for Businesses

We continue to work with our partners at the Michigan Chamber of Commerce and Choose Lansing to support the business community in navigating these changes. Now that the legislative fixes have passed the Michigan State Legislature and have been signed into law by Governor Whitmer, our focus shifts to educating businesses on the new laws and ensuring they have the necessary resources for compliance.

Below, you will find several documents, including FAQs from the Michigan Chamber of Commerce and the Michigan Department of Labor & Economic Opportunity (LEO), to help your business understand and implement these changes.

Webinar Series

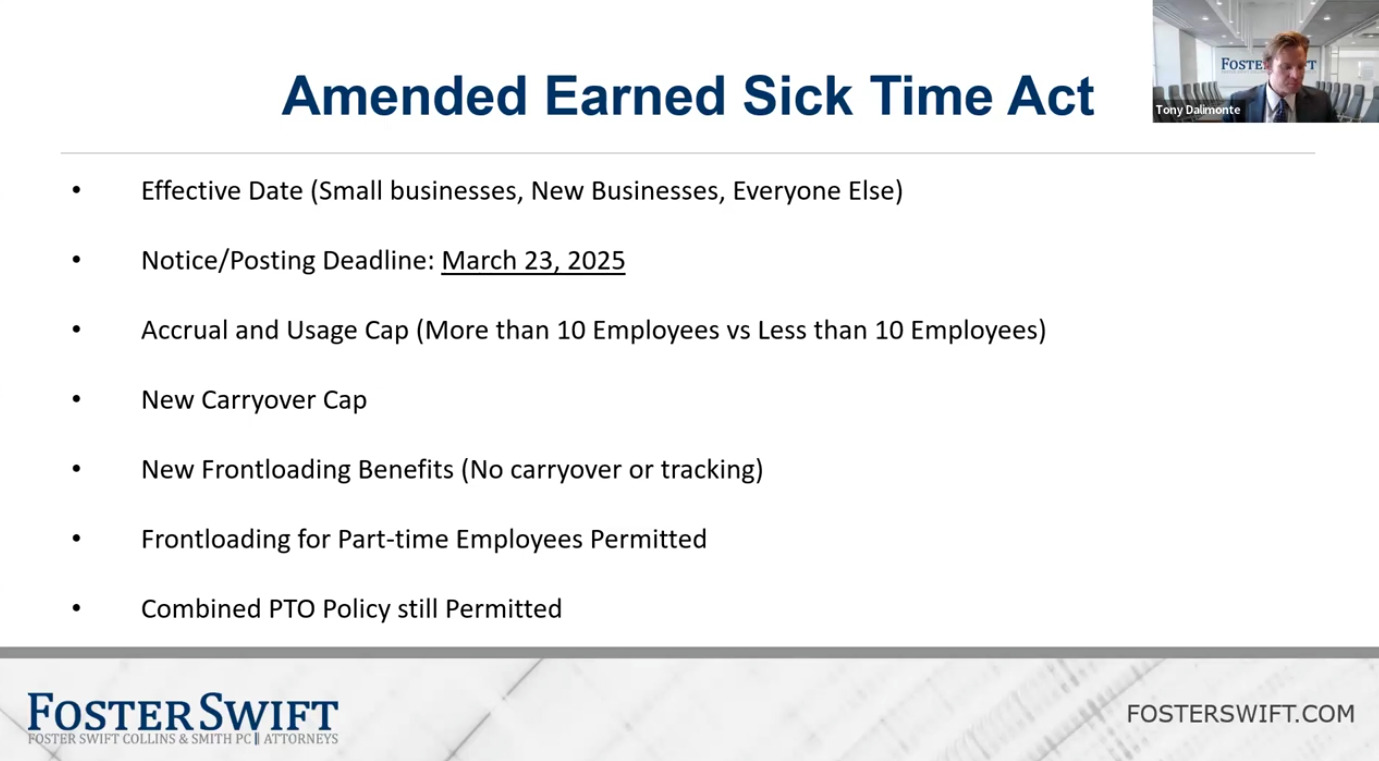

Labor & Employment Law Update: Paid Sick Leave & Minimum Wage.

- This session provides updates on labor and employment law, specifically focusing on Paid Sick Leave and Minimum Wage, presented by Foster Swift.

- The video and PowerPoint presentation are intended for informational purposes only.

- For further assistance or legal advice, please refer to the PDF in the "Additional Resources" section containing a list of Greater Lansing Legal Resources.

LRCC Policy & Regulatory Business Education Series

In response to the recent Michigan Supreme Court ruling on paid sick leave and minimum wage laws, the Lansing Regional Chamber of Commerce has launched the Policy & Regulatory Business Education Series presented by Foster Swift. This series is designed to guide businesses in achieving compliance by the February 21, 2025 deadline. Sessions are held at the Lansing Regional Chamber of Commerce and provide a unique opportunity for business owners to engage directly with attorneys, receive insights tailored to their specific needs, and have their pressing questions addressed.

These educational sessions have already seen strong participation from businesses across the region, highlighting the value of expert legal guidance and peer collaboration as they prepare for these legislative changes.

For details on upcoming sessions, please visit the Chamber's events page and join us as we continue to support our business community in adapting to new compliance requirements.

- Michigan Department of Treasury

- Michigan Department of Labor & Economic Opportunity

Additional Resources for Employers

- Posting Requirements

- Brochure

Michigan's Minimum Wage Rate

- Effective February 21, 2025, the minimum wage rate is $12.48 per hour.

- Effective January 1, 2026, the minimum wage rate is $13.73 per hour.

- Effective January 1, 2027, the minimum wage rate is $15.00 per hour.

Acts and Rules

- Michigan's Minimum Wage and Overtime law (Improved Workforce Opportunity Wage Act - Public Act 337 of 2018)

- Wage and Hour Division Administrative Rules

Frequently Asked Questions (FAQs)

Posting Requirements

Informational Sheets Michigan Minimum wage Law

News Articles

Help Desk

Our Public Affairs team is your dedicated advocate, ready to assist with any challenges your business, organization, or non-profit may face at the local, state, or federal levels of government. Whether it's navigating zoning issues, securing permits, handling licensure requirements, or ensuring business compliance, we are here to provide solutions and support. Our goal is to make it easier for you to get the answers you need, so you can focus on running your business smoothly.

Let us know how we can assist you today.